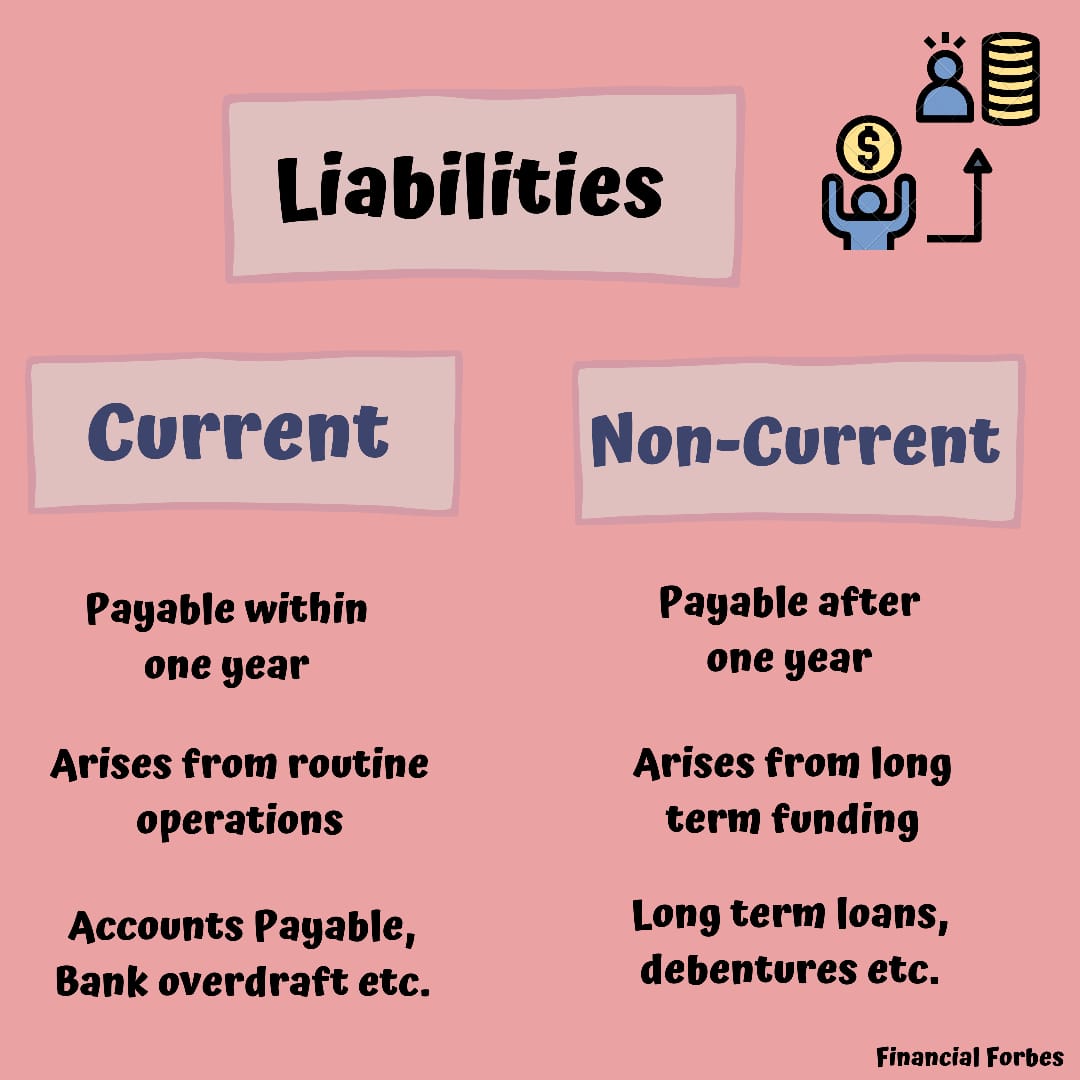

Any liability that’s not near-term falls under non-current liabilities that are expected to be paid in 12 months or more. Long-term debt is also known as bonds payable and it’s usually the largest liability and at the top of the list. Equity financing involves raising capital by issuing shares of stock.

Other Definitions of a Liability

These are recorded on a company’s income statement rather than the balance sheet, and are used to calculate net income rather than the value of assets or equity. When evaluating the performance of a company, analysts like to see that any short-term liabilities can be completely covered by cash. Any long-term liabilities should be able to be covered by revenue generated over time by assets.

What Is a Liability?

Liabilities are an important element of the operations of a company. They are key in helping financial operations and achieving growth. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

SG&A Meaning: Selling, General & Administrative Expenses (Definition)

As a small business owner, you’re going to incur different types of liabilities as you operate. It might be as simple as your electric bill, rent for your office or other types of business purchases. That said, if the lawsuit isn’t successful, then your business would not have any liability. A contingent liability only gets recorded on your balance sheet if the liability is probable to happen. When this happens, you can reasonably estimate the amount of the resulting liability.

Analyze shareholders’ equity components, including common and preferred stock, retained earnings, and dividends. A liability is something that a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. They’re recorded on the right side of the balance sheet and include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Long-term liabilities can also include lease obligations resulting from operating and finance leases.

- When the supplier delivers the inventory, the company usually has 30 days to pay for it.

- For example, a business looking to purchase a building will usually take out a mortgage from a bank in order to afford the purchase.

- A concept known as double-entry bookkeeping also called double-entry accounting is the backbone of basic accounting.[6]Financial Accounting Foundation.

- The EAR accounts for the impact of interest compounding over the year, ensuring that the interest rate per payment period reflects the true cost of borrowing.

- The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in.

Current Liabilities vs. Long-Term

A concept known as double-entry bookkeeping also called double-entry accounting is the backbone of basic accounting.[6]Financial Accounting Foundation. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle. By downloading this guide, you are also subscribing to the weekly G2 Tea newsletter to receive marketing news and trends. Learn more about Bench, our mission, and the dedicated team behind your financial success. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench.

Here are a few quick summaries to answer some of the frequently asked questions about liabilities in accounting. Assets are listed on the left side or top half of a balance sheet. Not sure where to start or which accounting service fits your needs?

With the right amount of liabilities, you can finance operations and pay for large expansions. Recognizing liabilities in the balance sheet can be tricky and a confusing bookkeeping responsibility. liabilities examples However, if you know the characteristics of a liability, you can categorize a transaction as one. And if you have more debt, then you’re going to have higher liabilities.