Thus the $6,000 loss shown as a deduction on the income statement is added back to net income, and it will be included later in the investing activities section as part of the proceeds from the sale of equipment. In effect, we are reversing the $6,000 loss because it is not an operating expense. First, the proceeds of the sale are added to the investing activities loss on sale of equipment cash flow section. Second, any gain or loss resulting from the sale should be removed from net income in the operating activities section of the cash flow statement if the indirect method is used. The cash flow statement summarizes a company’s cash inflows and outflows during a period. In other words, it includes a summary of cash generated and spent by a company.

Great! The Financial Professional Will Get Back To You Soon.

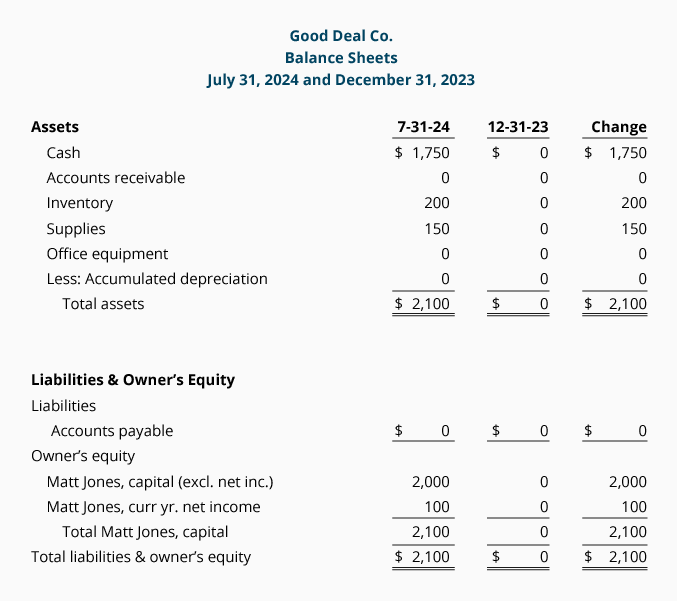

In thefirst instance, cash would have been expended to accomplish adecrease in liabilities arising from accrued expenses, yet thesecash payments would not be reflected in the net income on theincome statement. In the second instance, a decrease in deferredrevenue means that some revenue would have been reported on theincome statement that was collected in a previous period. Toreconcile net income to cash flow from operating activities,subtract decreases in currentliabilities. Increases in current assets indicate a decrease in cash, becauseeither (1) cash was paid to generate another current asset, such asinventory, or (2) revenue was accrued, but not yet collected, suchas accounts receivable.

Presentation of Gain or Loss on Asset Sale

- Since equipment is a noncurrent asset, cash activity related to the disposal of equipment should be included in the investment activities section of the statement of cash flows.

- Propensity Company had a noncash investing and financing activity, involving the purchase of land (investing activity) in exchange for a $20,000 note payable (financing activity).

- In contrast, cash flow from operating activities will decrease when there is an increase in prepaid expenses.

- When a company acquires a fixed asset, it will be an outflow under the same section.

- Recall that when a company purchases a fixed asset during a calendar year, it must pro-rate the first year’s 12/31 adjusting entry amount for depreciation by the number of months it actually owned the asset.

It is a gain over what the company has spent previously, but all that matters is what’s on the financial statements in this period. If the cash received is greater than the asset’s book value, the difference is recorded as a gain. If the cash received is less than the asset’s book value, the difference is recorded as a loss. Phantom’s most recent balance sheet, income statement, and other important information for 2012 are presented in the following. The adjustments reported in the operating activities section will be demonstrated in detail in “A Story To Illustrate How Specific Transactions and Account Balances Affect the Cash Flow Statement” in Part 3.

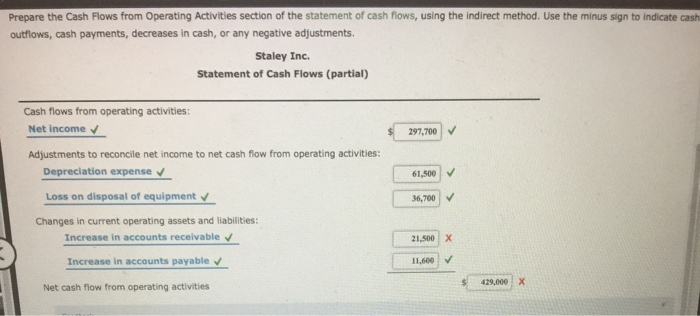

Example of indirect method of operating activities section

Debt transactions, such as issuance of bonds payable or notes payable, and the related principal payback of them, are also frequent financing events. Changes in long-term liabilities and equity for the period can be identified in the Noncurrent Liabilities section and the Stockholders’ Equity section of the company’s Comparative Balance Sheet, and in the retained earnings statement. Investing and financing transactions are critical activities ofbusiness, and they often represent significant amounts of companyequity, either as sources or uses of cash.

Part 2: Your Current Nest Egg

The truck’s book value is $7,000, but nothing is received for it if it is discarded. The equipment will be disposed of (discarded, sold, or traded in) on 4/1 in the fourth year, which is three months after the last annual adjusting entry was journalized. The first step is to journalize an additional adjusting entry on 4/1 to capture the additional three months’ depreciation. Since the annual depreciation amount is $1,200, the asset depreciates at a rate of $100 a month, for a total of $300. A loss results from the disposal of a fixed asset if the cash or trade-in allowance received is less than the book value of the asset.

Investing Activities Leading to an Increase in Cash

Similarly, if a fixed asset’s balance decreases from one year to the next, it means that some or all of it was sold and there was a cash inflow. To help determine the amount of cash received or paid, refer to the journal entry for each transaction to see if Cash was debited or credited. The first effect that a sale of fixed assets has on the cash flow statement is an adjustment to net profits. This adjustment adds any losses to the figure or subtracts profits from it. As mentioned above, these profits or losses relate to the fixed asset. By doing so, companies can remove the effect of the accounting treatment for the sale of fixed assets.

As non-cash expenses reduce net income without reducing cash, they are added back to net income under the indirect method. The other examples of expenses that require a similar treatment are the depletion of natural resources, the amortization of intangible assets, the amortization of bond discounts, etc. The following example illustrates the treatment of depreciation in the operating activities section. Figure 12.9 provides a summary of cash flows for operating activities, investing activities, and financing activities for Home Store, Inc., along with the resulting total decrease in cash of $98,000.

This is due to, the gains such as gains on disposal of the fixed asset or the gains on the sale of investments will increase the net income while the losses will decrease the net income on the income statement. Hence, we need to deduct the gains and add the losses in the adjustment that we need to make under the cash flows from operating activities. Operating activities are those involved in the day-to-day running of the business. Accounts used for operating activities include all those on the income statement as well as current assets and current liabilities on the balance sheet.