The preferred stock journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of preferred stock transactions. Of the preferred stock features noted here, the callable feature is less attractive to investors, and so tends to reduce the price they will pay for preferred stock. All of the other features are more attractive to investors, and so tend to increase the price they will pay for the stock.

isCompleteProfile ? “Setup your profile before Sign In” : “Profile”

In each of these examples the par value is meaningful because it is a factor in determining the dividend amounts. The preferred stock will be recorded as the equity part of the company on the balance sheet. In observing the preceding entry, it is imperative to note that the declaration on July 1 establishes a liability to the shareholders that is legally enforceable.

Possible Preferred Stock Features

Preferred stock is a type of stock that usually pays a fixed dividend prior to any distributions to the holders of the issuer’s common stock. This payment is typically cumulative, so any delayed prior payments must be paid to the preferred stockholders before distributions can be made to the holders of common stock. Convertible preferred stock is a corporate issued preferred stock with a conversion covenant attached to it. The number of common shares to be issued to the investor upon conversion are usually mentioned in the preferred stock agreement; for example, 2 common shares for each share of preferred stock owned.

Please Sign in to set this content as a favorite.

Earnings Per Share (EPS) is a crucial metric for investors, as it provides insight into a company’s profitability on a per-share basis. The issuance of preferred stock can significantly impact EPS calculations, primarily due to the fixed dividend payments that must be deducted from net income before calculating EPS for common shareholders. This deduction reduces the net income available to common shareholders, thereby lowering the EPS. The effect is more pronounced for companies with substantial preferred stock issuances, as the fixed dividends can represent a significant portion of net income. When it comes to dividends and liquidation, the owners of preferred stock have preferential treatment over the owners of common stock. In other words, preferred stockholders receive their dividends before the common stockholders receive theirs.

- Par value stock is a type of common or preferred stock having a nominal amount (known as par value) attached to each of its shares.

- They are being allowed to step in front of common stockholders when the specified rights are applied.

- Company ABC has issued the preferred shares to the capital market to raise additional capital.

- This means that when preferred stock is sold, its par value is recorded in the Preferred Stock equity account, while the excess amount of the sale is recorded in the Additional Paid-In Capital account.

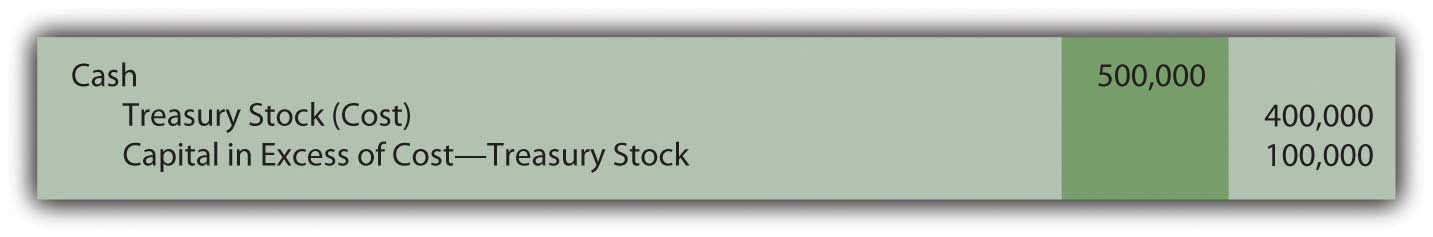

The “capital in excess of cost-treasury stock” is the same type of account as the “capital in excess of par value” that was recorded in connection with the issuance of both common and preferred stocks. Within stockholders’ equity, these accounts can be grouped or reported separately. As mentioned earlier in this chapter, all common stockholders are entitled to share proportionally in any dividend distributions. However, if a corporation issues preferred stock with a stipulated dividend, that amount must be paid before any money is conveyed to the owners of common stock.

Dividend accounting for preferred stock involves several nuanced considerations that ensure accurate financial reporting and compliance with accounting standards. The process begins with the declaration of dividends by the company’s board of directors. Once declared, dividends become a legal obligation, and the company must record a liability on its balance sheet.

Apparently, this definition is not absolutely correct in all possible cases. In the above journal entry, retained earnings are also reduced as a result of a stock transaction where a loss occurred that could not otherwise be reported. As an example, assume as before the business has issued the 1,000 7% preferred equity stock with a par value of 100 and an issue price of 105, but this time the stock is callable at 108. Occasionally, a corporation may issue no-par stock, which is recorded by debiting Cash and crediting Common Stock for the issue price.

Convertible preferred stock and convertible bonds are both dilutive securities i.e., they both can reduce firm’s earnings per share (EPS) if holders opt for conversion. The key difference between two convertibles is their distinct classification at the time of issuance. All types of preferred stock, including convertible ones, are classified as stockholders’ equity item unless a mandatory redemption exists.

The company earned a profit of $200,000 in Year 1 and $500,000 in year 2. Determine the maximum amount of profit available for distribution to common shareholders. If ten thousand shares of this preferred stock are each issued for $101 in cash ($1,010,000 in total), the company records the following journal entry.

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Preferred stock where the dividend could be more than the original, stated dividend. In each case the term deposit journal entries show the debit and credit account together with a brief narrative. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Another critical aspect of initial measurement is the classification of preferred stock. Depending on its features, preferred stock can be classified as either equity or a liability. For instance, if the preferred stock is mandatorily redeemable at a fixed date, it is classified as a liability because it represents an obligation publication 504 divorced or separated individuals to transfer assets in the future. Conversely, if the stock lacks a mandatory redemption feature and does not impose an obligation on the company, it is classified as equity. This classification impacts the company’s leverage ratios and overall financial health, making it a crucial consideration for both management and investors.